The outstanding balance of $2,000 that Craft did not repay will remain as bad debt. When a specific customer has been identified as an uncollectible account, the following journal entry would occur. There is one more point about the use of the contra account, Allowance for Doubtful Accounts.

Financial and Managerial Accounting

It, therefore, helps analysts make better predictions of the cash flows the company expects to receive from customers. Accounts receivable represent amounts due from customers as a result of credit sales. Unfortunately for various reasons, some accounts receivable will remain unpaid and will need to be provided for in the accounting records of the business. Bad debt expenses make sure that your books reflect what’s actually happening in your business and that your business’ net income doesn’t appear higher than it actually is. Accurately recording bad debt expenses is crucial if you want to lower your tax bill and not pay taxes on profits you never earned.

Heating and Air Company

For example, if 3% of invoices that are 90 days past due are considered uncollectible, you can assume that 97% of the invoices in this age group will be paid. As a general rule, the longer a bill goes uncollected past its due date, the less likely it is to be paid. Bad Debt Expense increases (debit) as does Allowance forDoubtful Accounts (credit) for $58,097. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

Direct Write Off Method

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. In order to use the allowance method, it is first necessary to estimate the allowance needed using a suitable method.

- For example, a jewelry store earns $100,000 in net sales, but they estimate that 4% of the invoices will be uncollectible.

- The basic idea is that the longer a debt goes unpaid, the more likely it is that the debt will never pay.

- If you use the accrual basis of accounting, you will record doubtful accounts in the same accounting period as the original credit sale.

- Using previous invoicing data, your accounting team will estimate what percentage of credit sales will be uncollectible.

- To establish an adequate allowance for doubtful accounts, a company must calculate its bad debt percentage.

- This is different from the last journal entry, where bad debt was estimated at $58,097.

As such, effective credit management and debt collection procedures should be a critical part of the evaluation of how to limit the effect bad debt can have on your business. Accountants use allowance for doubtful accounts to ensure that their financial statements accurately reflect the current state of their receivables. Many business owners use an easier method to write off outstanding accounts that have become uncollectible. It’s called the direct method, and if going public isn’t part of your long-term plans, you may want to consider using it. What happens when you discover that one of your receivables is actually uncollectible?

Pro Forma Financial Statements (with Templates and Examples)

Under the direct method, you assume that your total receivables are collectible and show their full value with no contra account on the balance sheet. If you later realize that an invoice is uncollectible, you make a journal entry to write off that receivable. After calculating your allowance for doubtful accounts at the end of the accounting period, you make a journal entry to record the adjustment in your company’s books. For example, a customer takes out a $15,000 car loan on August1, 2018 and is expected to pay the amount in full before December1, 2018.

It adds a significant delay between recognizing revenue from a transaction and identifying all expenses connected with that same transaction. Before the doubtful account is written off, the profitability of the transaction in question appears higher than it will be when the bad debt expense is finally added. Instead of the bad debt reserve calculation, companies may use the allowance method, which anticipates that some of a company’s existing debt will what is the turbotax audit defense phone number be uncollectible and accounts for that prediction right away. To establish an adequate allowance for doubtful accounts, a company must calculate its bad debt percentage. To make that calculation, divide the amount of bad debt by the company’s total accounts receivable for a period of time and then multiply that number by 100. Bad Debt Expense increases (debit), and Allowance for Doubtful Accounts increases (credit) for $48,727.50 ($324,850 × 15%).

For example, say as of December 31, 2022, ABC Supply Co. owes you $500 for goods purchased on credit. Then, in February 2023, the CFO informs you that the company filed for bankruptcy and won’t be able to pay the amount they owe. By a miracle, it turns out the company ended up being rewarded a portion of their outstanding receivable balance they’d written off as part of the bankruptcy proceedings. Of the $50,000 balance that was written off, the company is notified that they will receive $35,000. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

For the provision for bad debt write-off method, you would estimate all bad debt at the end of each accounting period, debit it to a bad debt account and credit your accounts receivable account. Then all of the category estimates are added together to get one total estimated uncollectible balance for the period. The entry for bad debt would be as follows, if there was no carryover balance from the prior period. The sales method estimates the bad debt allowance as a percentage of credit sales as they occur.

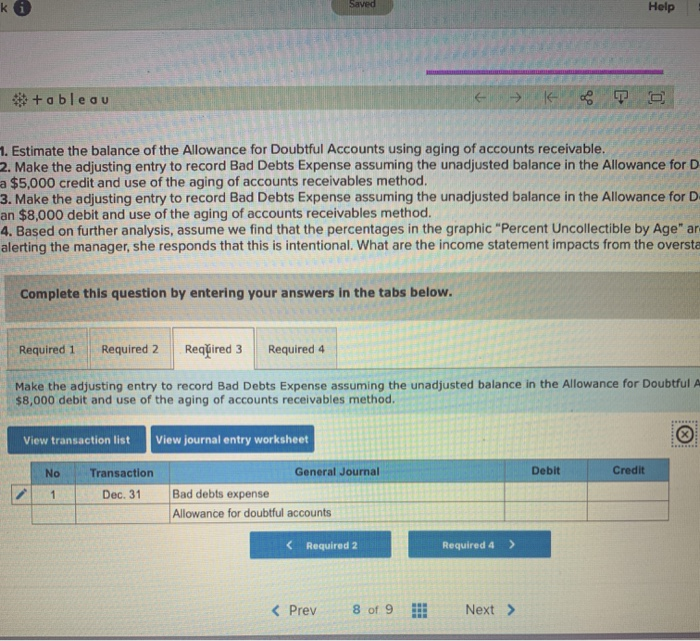

Companies often have a specific method of identifying the companies that it wants to include and the companies it wants to exclude. Because the allowance for doubtful accounts is established in the same accounting period as the original sale, an entity does not know for certain which exact receivables will be paid and which will default. Therefore, generally accepted accounting principles (GAAP) dictate that the allowance must be established in the same accounting period as the sale, but can be based on an anticipated or estimated figure.