Find the direct labor rate variance of Bright Company for the month of June. ABC Company has an annual production budget of 120,000 units and an annual DL budget of $3,840,000. Four hours are needed to complete a finished product and the company has established a standard rate of $8 per hour. The company used 39,500 direct labor hours and paid a total of $325,875.

Managing Labor Variance: Components, Calculations, and Strategies

As a result of this favorable outcome information, the company may consider continuing operations as they exist, or could change future budget projections to reflect higher profit margins, among other things. With either of these formulas, the actual rate per hour refers to the actual rate of pay for workers to create one unit of product. The standard rate per hour is the expected rate of pay for workers to create one unit of product.

Direct Labor Variances

If the tasks that are not so complicated are assigned to very experienced workers, an unfavorable labor rate variance may be the result. The reason is that the highly experienced workers can generally be hired only at expensive wage rates. If, on the other hand, less experienced workers are assigned the complex tasks that require higher level of expertise, a favorable labor rate variance may occur. However, these workers may cause the quality issues due to lack of expertise and inflate the firm’s internal failure costs. In order to keep the overall direct labor cost inline with standards while maintaining the output quality, it is much important to assign right tasks to right workers.

Financial and Managerial Accounting

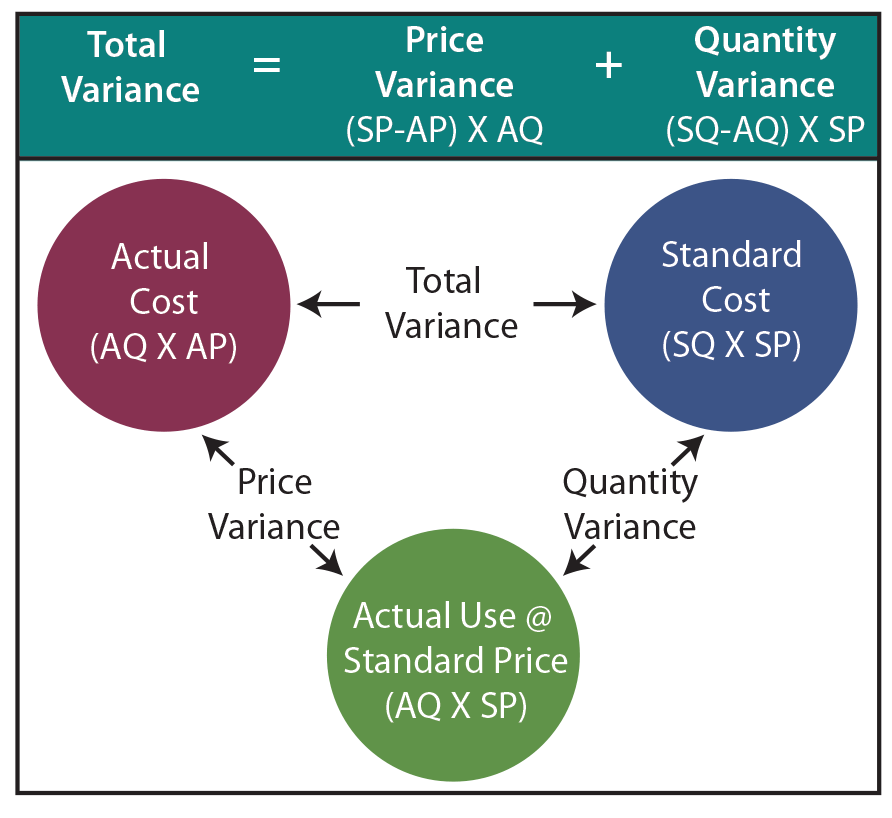

Figure 8.4 shows the connection between the direct labor rate variance and direct labor time variance to total direct labor variance. In this case, the actual rate per hour is \(\$7.50\), the standard rate per hour is \(\$8.00\), and the actual hour worked is \(0.10\) hours per box. The direct labor variance measures how efficiently the company uses labor as well as how effective it is at pricing labor.

It also provides insights into the effectiveness of human resource management initiatives. Another element this company and others must consider is a direct labor time variance. Advanced techniques for labor variance analysis go beyond basic calculations to provide deeper insights into labor performance. One such technique is variance decomposition, which breaks down overall labor variance into more granular components. This allows companies to pinpoint specific areas of inefficiency, such as particular departments or shifts that consistently underperform.

Advanced Techniques for Analysis

This awarenesshelps managers make decisions that protect the financial health oftheir companies. Labor variances also have implications for budgeting and forecasting. Persistent unfavorable variances may necessitate revisions to future budgets, impacting financial planning and resource allocation. Companies may need to adjust their labor cost assumptions, which can affect everything from pricing strategies to capital investment decisions.

If the outcome is unfavorable, the actual costs related to labor were more than the expected (standard) costs. If the outcome is favorable, the actual costs related to labor are less than the expected (standard) costs. So as we discussed, we can analyze the variance for labor efficiency by using the standard cost variance analysis chart on 10.3. Direct labor efficiency variance pertain to the difference arising from employing more labor hours than planned. If the total actual cost incurred is less than the total standard cost, the variance is favorable. Calculating DLYV can help organizations better control their labor costs, optimize production processes, and improve overall profitability.

- Conversely, favorable variances might indicate underutilization of labor resources, which could be a red flag for potential operational inefficiencies or overstaffing.

- Beyond the income statement, labor variances also affect the balance sheet.

- Direct Labor Mix Variance shows how much production is wasted and can be used as a tool to decrease Direct Labor Mix Variance.

- 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

- As a result of this unfavorable outcome information, the company may consider using cheaper labor, changing the production process to be more efficient, or increasing prices to cover labor costs.

- Tools like Tableau or Power BI can be instrumental in visualizing these variances, making it easier for managers to identify patterns and take corrective actions.

Minimizing labor variance requires a multifaceted approach that integrates both proactive and reactive strategies. By accurately forecasting labor needs based on historical data and market trends, companies can better align their staffing levels with production demands. This reduces the likelihood of overstaffing or understaffing, both of which can lead to unfavorable labor variances. Utilizing software tools like SAP SuccessFactors or Oracle HCM Cloud can enhance the precision of workforce planning, ensuring that labor resources are optimally allocated. Labor rate variance arises when labor is paid at a rate that differs from the standard wage rate. Labor efficiency variance arises when the actual hours worked vary from standard, resulting in a higher or lower standard time recorded for a given output.

The unfavorable will hit our bottom line which reduces the profit or cause the surprise loss for company. The favorable will increase profit for company, but we may lose some customers due to high selling price which cause by overestimating the labor standard rate. However, we do not need to investigate if the variance is too small which will not significantly impact the decision making. The actual hours used can differ from the standard hours because of improved efficiencies in production, carelessness or inefficiencies in production, or poor estimation when creating the standard usage. The labor variance can be used in any part of a business, as long as there is some compensation expense to be compared to a standard amount. It can also include a range of expenses, beginning with just the base compensation paid, and potentially also including payroll taxes, bonuses, the cost of stock grants, and even benefits paid.

An unfavorable outcome means you used more hours than anticipated to make the actual number of production units. All tasks do not require equally skilled workers; some the difference between fixed cost and variable cost tasks are more complicated and require more experienced workers than others. This general fact should be kept in mind while assigning tasks to available work force.